How to cope with the Reform of Social Security

Collection and Management

From January 1, 2019, the tax bureau will take over the approval and collection of the social security base that was previously under the jurisdiction of the Social Security Center. The phenomenon of not paying or underpaying social security will be eliminated. After strict law enforcement, the vast majority of private enterprises will have no profits, mainly affecting labor-intensive enterprises. The service industry includes logistics, hotels, and restaurants. The next step may also have housing fund strictly implemented, which will affect corporate profits badly. Additional employee liabilities are also required for individual workers. Companies may also need to raise their salary budgets in order to retain workers.

Under the current circumstances, how shall entrepreneurs to deal with it?

I. Companies that are fully compliant, paid in full and profitable enough to do so can solve the problem, but at a high cost

II. Ignoring and dividing part of the salary into wages does not solve the problem. The same employee in the same company cannot have a labor contract and contractor contract. IRS can demand repayments

These two methods above are not helpful to control the cost of the company.

III. Partnership plan. In practice, more companies use this. For example, some real estate agents, supermarkets, etc., to make internal partnership plans. In the past, companies paid employees, but now the internal team has registered a small microenterprise, turned into B2B, wages into labor fees, and employment relations into trading relationships. There are 2 ways for internal distribution of small and micro enterprises:

- 1. The small microenterprise distributes dividends, pay 0.5%-3.5% corporation income tax.

- 2. The small microenterprise determines the salary and social security level internally. This shifts the responsibility of the original employer to the internal staff of the team, but there is still social security payment for the new partnership. Internal teams may not necessarily motivate to do this.

IV. Hire interns and retirees, this type of employee no need to pay social security. But if the companies need more technical and qualified expertise, they may not be able to meet the requirements.

V. Make wages into labor remuneration, that is, sign contractor agreements with employees rather than labor contracts. The new personal tax law stipulates that income from remuneration for services, income from manuscripts and royalties shall be taxable according to the amount of each income, comply with 3%-45% progressive tax rate in excess of specific amount. Social security will be paid by the employee himself. This requires an agreement between the two sides. After all, the contractor agreement is no longer in one-to-one employment relationship, and employers may stop hiring at any time. There is a lack of stability for employees. On the other hand, Employees can also work for multiple companies, lacking loyalty to employers.

VI. Outsourcing, flexible employment. This practice is beneficial to the companies, and still has social security pressure on the employees.

VII. Part-time. Companies share one employee, 24 hours a week, and the labor law does not require social security. Same as Item V, the employees have more freedom. Under the current reform, this might be encouraged by government.

VIII. Increase the amount of housing fund. So far, there is no requirement that the housing fund must be paid in accordance with the wage base. The company that does not pay the housing fund can choose the upper limit of the fund and reduce the amount of salary. This option is based on that the housing fund has not under the monitor by IRS. And it does not apply to employees with high level salary.

IX. High severance package. The amount of severance compensation is not currently required by the rules on whether to pay high. Severance package which paid at three times the average annual salary is tax-free and does not count for social security. But it does not apply to long-term employees of the same company.

X. Sole trader or self-employee. Same as V and VII, the employees decide who to work for and can apply to the tax bureau for Fapiao. The employer no longer has the obligation to withhold the individual income tax. The social security will be paid by sole trader independently. The personal tax can be taxed as same tax rate as employed. This will benefit to both sides. The registration process for sole trader is not complicated. But there is annual reporting obligation for sole trader every year.

Take a look at the above measures,which methods are more effective on the basis of legal compliance have yet to be verified. Of course, if the business is profitable enough, it is recommended to pay in full. Or, we are counting on the government to reduce the share of social security contributions. After all, we are the country with the highest social security contributions in the world, but the welfare benefits are not even a bit near to the developed countries.

Table 1: Salary IIT rate---yealy base.

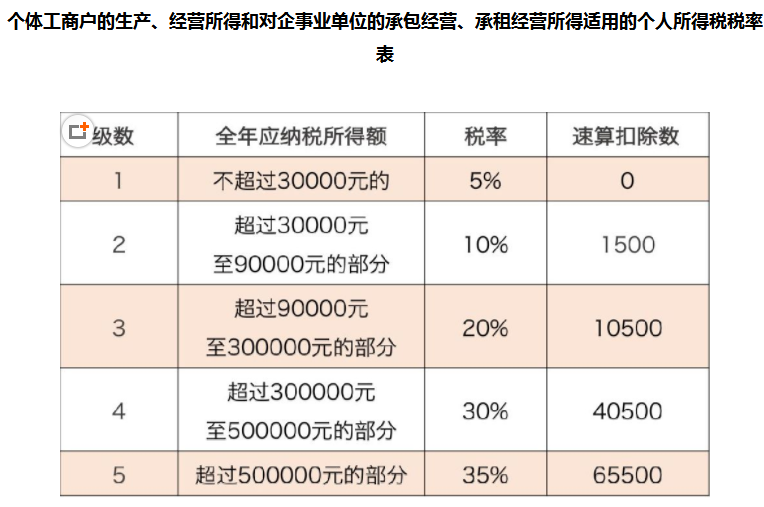

Table 2: Self-employee IIT Rate--yearly base

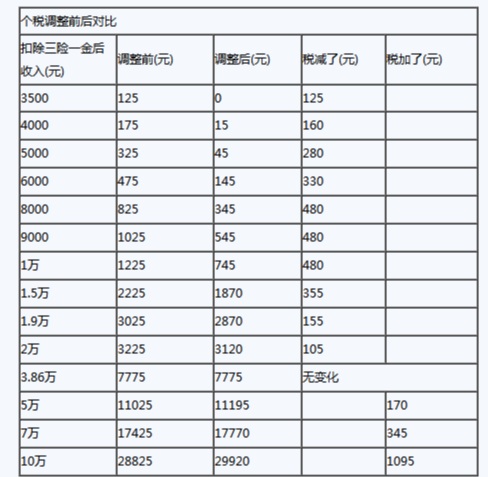

Table 3: Comparison with old IIT rate

Table 4: How much you could save under new IIT rate